Debt can be a burden for many individuals and families, but what if there was a way to turn that debt into wealth? Debt recycling is a concept that offers the potential to accelerate financial growth by utilizing existing debt as a strategic tool. In this article, we will explore the basics of debt recycling, delve into its mechanics, discuss the benefits it can bring, and address the risks and challenges involved. Additionally, we will provide practical steps for implementing a debt recycling strategy and offer tips for success.

Understanding the Concept of Debt Recycling

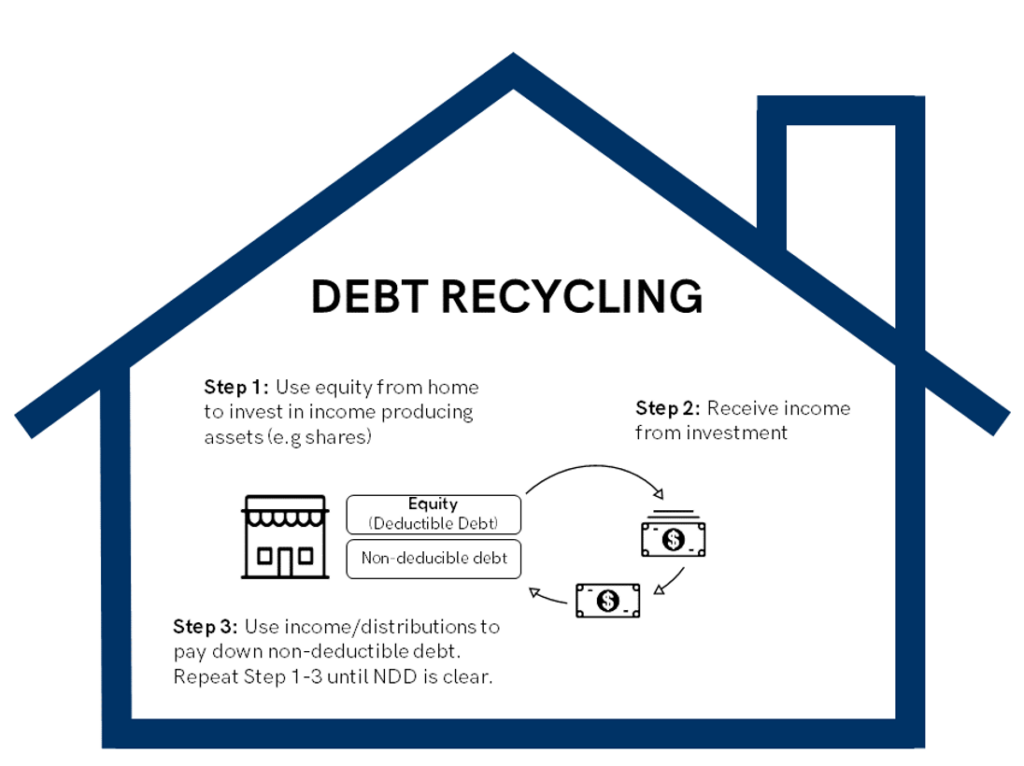

Debt recycling is a financial strategy that involves using equity in existing property or investments to generate new borrowings, which are then used to invest in income-producing assets. The aim is to ‘recycle’ the debt by redirecting it into investments that have the potential to appreciate in value and generate income, thus increasing overall wealth.

One key aspect to consider when debt recycling explained, is the importance of conducting thorough research and analysis on potential investment opportunities. It is crucial to assess the risk and return profile of each investment to ensure that it aligns with your financial goals and risk tolerance.

The Basics of Debt Recycling

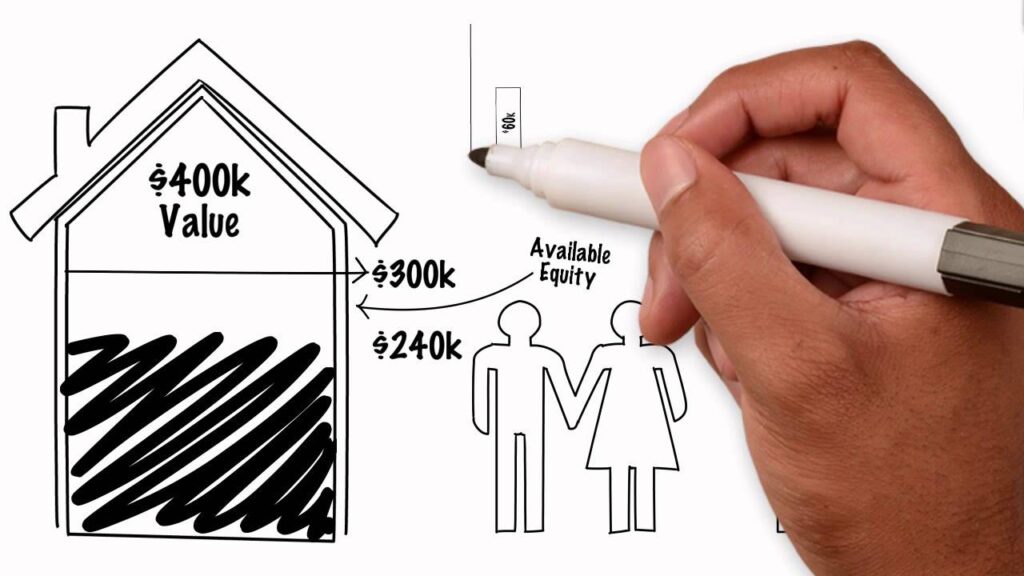

The core principle of debt recycling lies in utilizing the equity of existing assets as collateral for new borrowings. To illustrate, let’s imagine an individual who owns a property worth $500,000 with an outstanding mortgage balance of $300,000. By refinancing the property and increasing the loan amount to $400,000, they can access $100,000 in equity.

This additional funding can then be used to invest in income-producing assets such as shares, managed funds, or property. The income generated from these investments can be used to offset the interest costs of the new borrowing, potentially reducing the overall financial burden.

Furthermore, it is essential to regularly review and adjust your debt recycling strategy to adapt to changing market conditions and financial goals. By staying informed and proactive, you can optimize the benefits of debt recycling and enhance your wealth creation potential. You can visit https://lincolnlawreview.org/debt-recycling-explained-strategies-for-converting-liabilities-into-assets to get about strategies for converting liabilities into assets.

The Role of Debt Recycling in Wealth Creation

Debt recycling plays a vital role in wealth creation by leveraging existing assets to generate additional income and capital growth. By recycling debt strategically, individuals can accelerate their financial growth and build a more substantial asset base over time.

It is important to note that debt recycling is a long-term strategy that requires discipline and careful planning. By seeking professional financial advice and continuously educating yourself on investment opportunities, you can maximize the benefits of debt recycling and work towards achieving your financial objectives.

The Mechanics of Debt Recycling

How Debt Recycling Works

The mechanics of debt recycling involve a series of steps that enable individuals to effectively utilize their existing debt as a wealth-building tool. Here’s a breakdown of the key components:

- Assessment and Planning: The first step is to assess the existing debt, including its interest rate and the equity available in assets. This evaluation helps in determining the feasibility and potential benefits of debt recycling.

- Refinancing: Refinancing existing loans or mortgages allows individuals to access equity and redirect it towards investments that have the potential for income generation and capital appreciation.

- Investment Allocation: Once the additional borrowing is in place, careful consideration should be given to selecting the most appropriate income-producing assets. Diversification and risk management are crucial factors to consider.

- Income Offset: The income generated from the investments should be used to offset the interest costs of the new borrowing. This approach helps in reducing the overall financial burden and accelerates the wealth creation process.

- Regular Monitoring and Adjustment: Monitoring the performance of the investments, reviewing the debt structure, and making adjustments as needed is essential for maximizing the benefits of debt recycling.

Key Components of Debt Recycling

Debt recycling consists of several key components that contribute to its effectiveness:

- Equity leveraging: The ability to access equity in existing assets allows individuals to generate additional borrowings for investment purposes. This leverage amplifies potential returns.

- Income generation: The investments made using the borrowed funds should be chosen to generate income, which can be used to offset interest costs and accelerate wealth creation.

- Capital appreciation: Selecting assets that have the potential for capital appreciation increases overall wealth over time. This growth can contribute to long-term financial goals such as retirement planning.

- Tax advantages: Debt recycling can offer tax advantages, particularly if the income generated from the investments is taxed at a lower rate than the interest expense on the borrowing.

While the mechanics of debt recycling may seem straightforward, it is important to delve deeper into the intricacies of each step to fully understand its potential. The assessment and planning stage, for example, requires a meticulous evaluation of the existing debt. This includes not only considering the interest rate but also examining the equity available in assets. By thoroughly assessing these factors, individuals can determine whether debt recycling is a viable strategy for them.

Refinancing, another crucial step in debt recycling, allows individuals to tap into the equity of their existing loans or mortgages. This opens up new opportunities to redirect the borrowed funds towards investments that have the potential for both income generation and capital appreciation. Careful consideration should be given to selecting the right income-producing assets during the investment allocation phase. Diversification and risk management play a vital role in ensuring a balanced portfolio that maximizes returns while minimizing potential risks.

One of the key advantages of debt recycling is the ability to offset interest costs with the income generated from investments. This approach not only reduces the overall financial burden but also accelerates the wealth creation process. It is essential to regularly monitor the performance of the investments and review the debt structure to make necessary adjustments. By staying proactive and making informed decisions, individuals can maximize the benefits of debt recycling and achieve their financial goals.

Benefits of Debt Recycling

Accelerating Financial Growth

One of the primary benefits of debt recycling is its potential to accelerate financial growth. By strategically investing borrowed funds in income-producing assets, individuals can generate additional income and capital growth, compounding their overall wealth.

Moreover, debt recycling allows individuals to leverage their existing assets to access additional funds for investment, without having to liquidate their current holdings. This can lead to a more diversified investment portfolio and potentially higher returns over the long term.

Reducing Tax Liabilities

Debt recycling can also provide opportunities for reducing tax liabilities. By carefully structuring the investments and taking advantage of tax deductions, individuals may be able to lower their overall tax obligations.

Furthermore, certain investment strategies within debt recycling, such as investing in tax-efficient assets like shares or property, can help individuals minimize the impact of capital gains tax and maximize their after-tax returns.

Risks and Challenges of Debt Recycling

Potential Risks Involved

Like any financial strategy, debt recycling comes with potential risks. These risks primarily revolve around the performance of the investments made and the ability to generate sufficient income to offset the interest costs. Market volatility and economic factors can impact the returns and introduce risks.

One significant risk to consider is the potential for investment underperformance. If the chosen investments do not perform as expected, it can lead to a situation where the returns are not enough to cover the interest costs of the debt. This scenario can result in financial losses and may hinder the overall effectiveness of the debt recycling strategy.

Overcoming Common Challenges

To mitigate the risks associated with debt recycling, a thoughtful approach is essential. Adequate research and professional guidance can help individuals identify suitable investments, manage potential risks, and navigate any challenges that may arise.

Furthermore, staying informed about market trends and economic indicators is crucial for making informed investment decisions. By keeping a close eye on the financial landscape, individuals engaging in debt recycling can adjust their strategies in response to changing market conditions, potentially reducing the impact of external risks on their investment portfolio.

Implementing a Debt Recycling Strategy

Steps to Start Debt Recycling

Implementing a debt recycling strategy requires careful planning and execution. Here are some steps to get started:

- Evaluate Existing Debt: Assess your existing debts, including mortgage balances and interest rates. Determine the equity available in your assets.

- Review Investment Opportunities: Research various income-producing assets and carefully consider their potential for generating income and capital growth.

- Consult with Professionals: Seek advice from financial advisors or mortgage brokers experienced in debt recycling strategies. They can provide valuable insights and guide you through the process.

- Refinance and Invest: If debt recycling is deemed suitable for your financial goals, work with your chosen professional to refinance and invest the borrowed funds.

- Monitor and Adjust: Regularly monitor the performance of your investments and review the debt structure. Make adjustments as needed to optimize results.

Now that you have a clear understanding of the initial steps involved in debt recycling, let’s delve deeper into each of these steps to ensure you have a comprehensive understanding of the process.

Step 1: Evaluate Existing Debt

When evaluating your existing debt, it’s important to consider not only the outstanding balances but also the interest rates associated with each debt. This will help you determine which debts are costing you the most and should be prioritized for debt recycling. Additionally, assessing the equity available in your assets will give you an idea of how much you can potentially borrow to invest.

Step 2: Review Investment Opportunities

Researching investment opportunities is a crucial part of the debt recycling process. It’s essential to carefully consider the potential income and capital growth of each investment. Look for assets that align with your risk tolerance and long-term financial goals. Diversification is key to managing risks effectively, so explore various asset classes such as stocks, bonds, real estate, and even alternative investments like cryptocurrencies.

Step 3: Consult with Professionals

Seeking advice from professionals who specialize in debt recycling strategies can provide you with valuable insights and guidance throughout the process. Financial advisors, mortgage brokers, and tax specialists can help you navigate the complexities of debt recycling, ensuring that you make informed decisions that align with your financial goals. They can also assist you in finding the best refinancing options and investment opportunities that suit your needs.

Step 4: Refinance and Invest

Once you have evaluated your existing debt, reviewed investment opportunities, and sought professional advice, it’s time to refinance and invest the borrowed funds. Working closely with your chosen professional, you can explore refinancing options that offer favorable interest rates and terms. The borrowed funds can then be strategically invested in income-producing assets, setting the stage for potential wealth creation.

Step 5: Monitor and Adjust

Monitoring the performance of your investments and regularly reviewing the debt structure is crucial to optimizing results. Keep a close eye on the income generated by your investments and assess whether they are meeting your expectations. Additionally, review the debt structure periodically to ensure it aligns with your financial goals. Making adjustments as needed will help you stay on track and make the most of your debt recycling strategy.

Tips for Successful Debt Recycling

Successful debt recycling requires ongoing commitment and careful management. Here are some tips to enhance your chances of success:

- Seek professional guidance: Engage with financial advisors, mortgage brokers, and tax specialists who specialize in debt recycling strategies. Their expertise will help you navigate the complexities of the strategy and make informed decisions.

- Research and diversify: Thoroughly research investment opportunities and diversify your portfolio to manage risks effectively. A well-diversified portfolio can help protect your investments from market fluctuations and maximize potential returns.

- Regularly review and adjust: Regularly monitor the performance of investments and review the debt structure to ensure alignment with your financial goals. By staying proactive and making necessary adjustments, you can adapt to changing market conditions and optimize your strategy.

- Keep long-term goals in mind: Debt recycling is a long-term strategy, so it’s important to remain focused on your financial goals and be patient with the progress. Remember that wealth creation takes time, and staying committed to your strategy will yield results over the long run.

In conclusion, debt recycling offers a powerful approach to turn debt into wealth by strategically utilizing existing debt as a tool for financial growth. By understanding the basics, mechanics, benefits, risks, and challenges associated with debt recycling, individuals can effectively implement a strategic approach to accelerate their financial growth and build a stronger asset base for the future.